Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Moving into your own home after graduating is such an exciting opportunity. It’s all about celebrating your independence and embracing the countless opportunities that lie ahead. But you know what they say: great freedom comes with great responsibility, especially when managing your finances. If you’re not careful, it can pose some challenges.

What’s really important when you start living alone after college? It’s managing your finances and finding ways to cut costs. You want to avoid ending up going over budget and stressing about money. The key is to be innovative and eliminate any unnecessary expenses. Stick to what you really need and avoid spending on things that can drain your wallet.

In This Post:

Cool Tricks To Cut Costs When You’re Moving Into Your Own Home After College

1. Create A Budget

Before you make the big move, creating a budget is crucial. Figure out how much money you’ll need for all your necessary expenses. Remember to include moving truck rentals and packing supplies in your calculations. When you have a well-thought-out plan, you can quickly identify what’s essential and what’s not.

2. Pay Off Your Debt Gradually

As a recent college graduate, you likely have student loan debt hanging over your head. Paying off all student loan debt before moving out might require staying home for an extended period. Reducing student loan debt before independent living helps secure a better financial future with fewer additional expenses.

Consider refinancing student loan options to help you pay off your student debt. The sooner you pay your student loans, the faster you will be debt-free.

3. Consider Room Sharing

Renting an apartment requires upfront payment of the first month’s rent, the last month’s rent, and a security deposit. This can be costly and challenging if you still need to save that amount. Consider having roommates to share the expenses. Sharing the costs can make it more affordable for everyone involved.

4. Sell Unused Belongings

Now’s the time to go through your clothes, music, movies, old dorm mini-fridge, and other items you don’t need. Selling them has two benefits: you earn money for your move and lighten your load, saving time and energy. If you have items that won’t sell, consider donating them to a worthy charity. It’s a win-win – you declutter and help others in need.

5. Seek Help From Friends And Family

Hiring professional movers to pack and transport your belongings is convenient but pricey. Local movers often charge around $100 per hour, totaling $300-$600. Long-distance moves are even more expensive. Instead, consider asking friends or family to help in exchange for food and drinks. Promise to return the favor someday.

6. Cook Your Meals

One of the most effective ways to save money is by cooking your meals regularly. Learning to prepare your meals instead of buying takeouts can cut your food expenses in half. Plus, homemade meals are generally healthier than prepared foods. Remember to use a microwave for reheating leftovers.

7. Save Electricity

It’s best to turn off or unplug lights, appliances, and devices if no one’s using them. It may seem small, but it can save money on your energy bill. Also, think about getting a programmable thermostat. It lets you control heating and cooling settings and can help you cut down on energy costs. It’s a wise investment for your wallet and the environment.

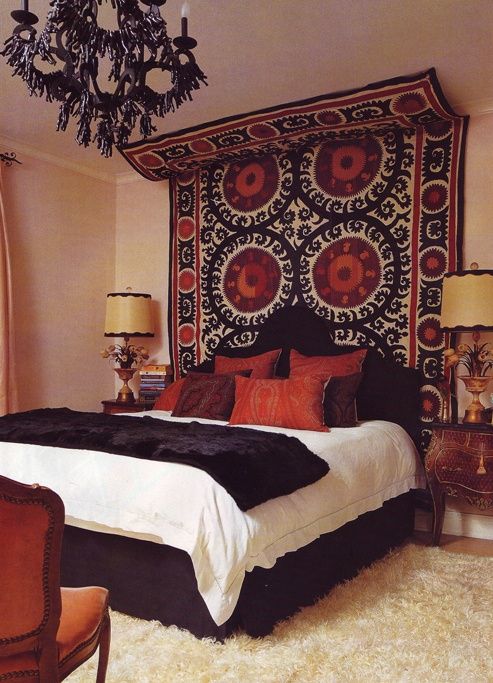

Take advantage of natural light in your room. It is the most effective way to cut electricity costs. Turn off your lights in the morning and open your windows to let the light come in. Use bright-colored curtains for your windows to allow light into your room still.

The Bottom Line

Moving into your own home after college could be a big decision in your life. This could be your first step into the real world as an adult. Moving can be expensive, but you must learn to be financially wise and independent to avoid problems.